Get the free uc 018 form

Show details

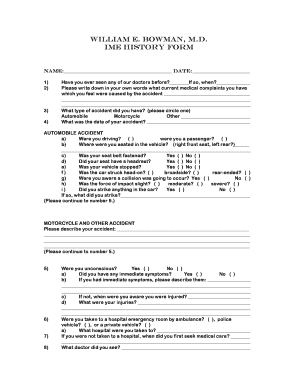

UC-018-A (3-02) ARIZONA DEPARTMENT OF ECONOMIC SECURITY Employment Security Administration Unemployment Tax P.O. Box 6028 Phoenix, Arizona 85005-6028 NOTICE OF ASSESSMENT EMPLOYER'S NAME ACCOUNT NO.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your uc 018 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your az uc 018 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form uc 018 online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uc018 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uc 018 ff form

How to fill out uc 018:

01

The first step is to obtain the UC 018 form. You can typically find this form online on the official website of the organization or institution that requires it.

02

Once you have the form, carefully read and follow the instructions provided. Make sure you understand all the sections and requirements before starting to fill it out.

03

Begin by providing your personal information in the designated fields. This usually includes your full name, address, contact details, and any other information requested.

04

Next, fill out any sections related to your employment or educational background, if applicable. This might include details about your current or previous job, your position, and the organization or institution you are affiliated with.

05

Move on to the main part of the form, which typically requires you to provide specific information or answer questions related to the purpose of requiring the UC 018. Read each question carefully and provide accurate and truthful responses.

06

If there are any additional sections or attachments required, make sure to complete them accordingly. This might include providing supporting documents, attaching photographs, or providing any other necessary information.

07

Once you have filled out all the required sections of the form, review it carefully. Check for any errors or missing information, and make sure everything is complete and accurate.

08

Finally, sign the form in the designated space and date it appropriately. If there are any additional signatures required, ensure they are obtained before submitting the form.

Who needs uc 018?

01

Individuals who are applying for a specific program or position that requires the completion of UC 018 may need to fill out this form.

02

Organizations or institutions that require certain information or documentation from individuals may ask them to fill out UC 018.

03

Anyone who wants to provide accurate and truthful information related to their employment, educational background, or any other purpose may consider filling out UC 018.

Fill

uc 018 form 2025

: Try Risk Free

People Also Ask about arizona des unemployment

Who do you pay Arizona unemployment tax to?

In Arizona, the Unemployment Insurance (UI) Program is administered through a federal-state partnership between the U.S. Department of Labor (DOL) and the Department of Economic Security (DES). Arizona employers are required to pay both a federal and a state unemployment excise tax.

Am I liable for federal unemployment tax?

Only the employer pays FUTA tax; it is not deducted from the employee's wages. For more information, refer to the Instructions for Form 940.

How do I get my Arizona withholding account number?

Your Arizona Withholding Account Number is the same number as your nine digit (XX-X) Federal Employment Identification Number (EIN). This number will auto-populate in the Withholding Account Number field when you enter your EIN during Square Payroll sign up.

Which of the following is responsible for paying unemployment tax?

Only the employer pays FUTA tax; it is not deducted from the employee's wages. For more information, refer to the Instructions for Form 940.

How do I close my Arizona unemployment account?

Please close your AZ Unemployment account by filling out the Report of Changes Form or requesting the closure through the state's online portal. Please reach out to Justworks support for either a pre-filled version of the paper form or instructions for completing the closure through the online portal.

What disqualifies you from unemployment in Arizona?

Refusing a genuine offer of suitable work without good cause; Retirement pay (other than Social Security); Severance Pay; and. Vacation or holiday pay if allocated to a period during which benefits are claimed.

How much is the maximum unemployment benefit in Arizona?

A weekly benefit amount is determined - The highest amount of wages paid in a quarter of the worker's base period determines the weekly benefit amount. The minimum weekly amount is $200, the maximum is $320.

How do I get my Pua back pay in Arizona?

You must contact the UI Call Center (toll free) at 1-877-600-2722.

What is the wage base for unemployment in Arizona 2023?

Important Update: Effective January 1, 2023, Arizona's Unemployment Taxable Wage Base Will Increase to $8,000.

How do I get my tax info from AZ unemployment?

Beginning February 1, 2023, if you received UI benefits in the calendar year 2022, you can log in to the Weekly Claims portal and view and print your 1099-G information in the "View Benefits Paid 1099" tab.

How do I find my Arizona unemployment account number?

Can't Locate Your Arizona Unemployment Tax Account Number? If you've filed state payroll tax returns in the past, you can find your Unemployment Tax Account Number on any previously submitted Unemployment Tax and Wage Report (UC-018). Call the Arizona Department of Economic Security at 602-771-6602.

Do I have to pay taxes on my Arizona unemployment?

All benefits are considered gross income for federal income tax purposes.

How do I change my tax withholding on unemployment Arizona?

After selecting your tax withholding on the initial Unemployment Insurance (UI) application, you can change your withholding preferences by completing the Voluntary Election for Federal/State Income Tax Withholding form (UB-433). After completing the form, submit it to DES by mail or fax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona department of economic security phoenix to be eSigned by others?

Once your uc 018 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in uc 018 form?

The editing procedure is simple with pdfFiller. Open your uc 018 form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete uc 018 form on an Android device?

Use the pdfFiller app for Android to finish your uc 018 form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is uc 018 ff?

UC 018 FF is a form related to unemployment compensation that is used to gather information for the processing of unemployment benefits.

Who is required to file uc 018 ff?

Individuals who are applying for unemployment benefits or are required to report information related to their unemployment claim need to file UC 018 FF.

How to fill out uc 018 ff?

To fill out UC 018 FF, individuals must provide accurate personal information, details about their employment history, and the reason for their unemployment on the form.

What is the purpose of uc 018 ff?

The purpose of UC 018 FF is to collect necessary information to determine eligibility for unemployment benefits and ensure proper processing of claims.

What information must be reported on uc 018 ff?

UC 018 FF requires the reporting of personal identification details, employment history, earnings during the base period, and the reason for unemployment.

Fill out your uc 018 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uc 018 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.